Aug

18

Breaking Down The Mobile Wallet Concept – Mobile, Umbrella & Integrated

In the previous post in my mobile wallet series, I talked about dividing the mobile wallet concept into two groups: proximity wallets and remote wallets. In this post, I’ll further break down the mobile wallet concept to help you better understand it in depth.

Mobile wallet concept

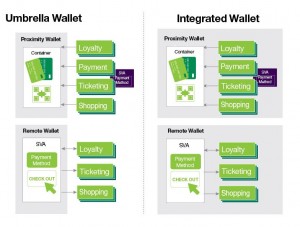

A mobile wallet is a container to store digitized valuables for authorization. A proximity mobile wallet is used for transactions involving entities that are physically close to each other, and a remote mobile wallet involves transactions for entities that are not physically close. Each of these two main groups of wallets can be further divided into umbrella and integrated wallets, which is what I’ll be talking about in this post.

Umbrella wallets

Umbrella wallets are loosely coupled with various services, such as loyalty cards, payment cards, tickets, coupons and so on. This means that in umbrella wallets, the services are stand-alone applications that can be connected to the wallet using certain interfaces.

Umbrella proximity wallets can be seen as a launch platform. An umbrella proximity wallet displays digital valuables such as QR codes and credit cards within a single container. Several independent applications can be started within this launch platform to manage these valuables. For example, clicking on a credit card symbol in an umbrella proximity wallet starts an app from the card-issuing bank. The management of payment processing, authentication, transaction history and so forth for this specific payment service is done through this independent app, not the proximity wallet app.

The PayPal approach represents an umbrella remote wallet because PayPal, as a stand-alone payment method, can be integrated into independent applications such as e-commerce sites or mobile services like mobile ticketing.

Umbrella wallet & Integrated wallet

Integrated wallets

In contrast to umbrella wallets, integrated wallets have all services fully integrated within the wallet.

An integrated proximity wallet contains standardized processes, such as for payments (for example, payment processing, authentication and transaction history). Service providers, such as card issuing banks, do not require their own app but instead use the integrated processes for payment processing.

An example of an integrated remote wallet is the application of a service provider (for example, for an e-commerce shop) that stores payment data and user data. The remote wallet is owned by this service provider and is a fully integrated part of its mobile or web service, like a web shop.

Furthermore, it is possible to combine umbrella and integrated wallets within a single wallet (for example, for different kinds of services or as an optional choice).

The right strategy for your context

To develop the right mobile wallet strategy for any given client, it is important to define the core mobile wallet concept among the strategic business targets first, because functionality and expandability of the wallet essentially depend on it. Remote wallets, for example, are not conceptualized for card emulation. Proximity wallets are not suitable for remote payment services within e-commerce and m-commerce environments.

Now that we’ve covered the mobile wallet concept in depth, in my next post, We’ll discuss mobile wallet services and functions. Stay tuned..

Article Credits: Danny Fundinger Breaking down the mobile wallet concept