Sep

11

Mobile wallet analytics and personalization: The value of data

We talked about the integration and deployment of various mobile wallet services for a user, but mobile wallets can go further and offer distinct capabilities for consumer data analytics and personalization.

Both service providers and customers benefit from the analysis of essential customer data that can be collected from mobile wallets. The service providers gain valuable information, and the customers receive more personalized and relevant offers.

Mobile wallet analytics: Capture, engage, execute

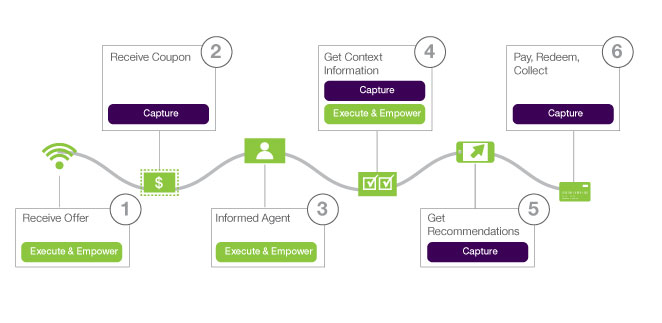

Mobile wallets act as a central platform for data collection and consumer interaction. Figure 1 illustrates various possibilities for the use of mobile wallet analytics along a customer journey through a retail shop:

Receive offers: Customers can receive targeted offers based on shopping history and context (location, weather and so on) through mobile wallet push notifications. This can raise their awareness and interest in visiting the shop.

Receive coupons: Customers may get a coupon when they check in to the shop. In the background, data that shows when customers have entered is being collected.

Get help from informed agents: Retail agents are informed when an individual customer has entered the shop using check-in. The agent can then look at the customer’s data, like name, spending history and preferences to better approach and advise him or her.

Get context information: While strolling around in the shop, customers can receive contextual information through Bluetooth low energy (BLE), near field communications (NFC), QR codes and so forth, which helps them to compare and rate products, and to find and keep track of their favorites.

Get recommendations: Based on the interests and interactions of the customer in the shop, he or she receives personalized recommendations on products in real time.

Pay, redeem, collect: Customers can redeem coupons and loyalty points when they pay. These actions are tracked in the wallet to further improve analytics and personalization for the individual customer.

This scenario illustrates how mobile wallet analytics could be applied in a retail environment, but of course analytics can be used in customer journeys in many other industries as well.

Example of a customer journey with a mobile wallet

Big data and analytics for mobile wallets

Harvesting these opportunities requires appropriate systems for analytics and for the evaluation of mobile wallet customer data (using innovative big data tools or cognitive systems like IBM Watson).

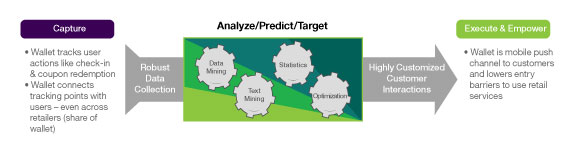

These analytics tools are already available and can be integrated into mobile wallet concepts, as shown in Figure 2.

Wallets in the context of analytics and big data systems

Capture: Mobile wallets capture data by tracking user actions (such as coupon redemption or check-ins) and connecting tracking points with users—even across different services and retailers (share of wallet). This data is collected and analyzed using data mining, text mining, statistics and optimization to produce highly customized interactions for consumers, which leads to a more engaging experience.

Execute and empower: When data has been analyzed, the mobile wallet is the direct interface to the customer, which allows retailers to push the relevant mobile offers and coupons to their customers. The integration in the mobile wallet also lowers the entry barrier for customers for using such retail services, as they are not required to install specific apps from the retailer.

A new level of customer relationship management

Thanks to the possibilities of mobile wallet analytics, the provider of a mobile wallet can have a comprehensive customer relationship that expands far beyond the scope of opportunities provided by traditional loyalty programs. This relationship could extend across the various services provided in the mobile wallet.