Aug

17

Proximity and remote mobile wallets: What’s the difference?

In my last post, I talked about the definition of a mobile wallet. Now that you have a basic understanding of what a mobile wallet is, I want to address two groups of mobile wallets: proximity mobile wallets and remote mobile wallets.

The term mobile wallet is often used in the industry for each of these groups, though there are significant differences in their usage scenarios, business design and technology implementation. Mobile wallet is a general term from which you can distinguish two groups—proximity wallets and remote wallets—using the following definitions:

Proximity mobile wallets

Proximity Mobile Wallets

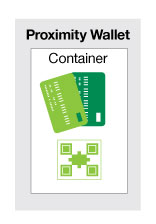

A proximity wallet (also called mobile wallet or NFC wallet) is used for authorization and transactions involving entities that are physically close to each other.Proximity mobile wallets

The core usage scenario is a proximity interaction between the mobile wallet and the control or acceptance entity. This concept is based on card emulation and provides a container where the card data is represented. Proximity wallets follow the underlying idea of digitizing the physical wallet, which I described in the series introduction, “What is a mobile wallet, and how does it work?”

Like a card, the digitized valuables contained in the proximity mobile wallet can be exposed to acceptance terminals or authorities for the control or exchange of secure information. For example, a mobile ticket is shown to the conductor or at the check-in gate, or a virtual credit card is held against a payment acceptance terminal.

You can distinguish between light proximity wallets that allow the storage of visual valuables (QR codes, textual codes, images of documents such as identity cards and so on) and full NFC proximity wallets that enable card emulation using secure elements and NFC interfaces.

Remote mobile wallets

Remote Mobile Wallets

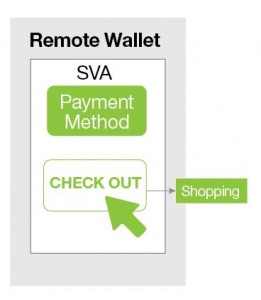

In contrast to proximity wallets, with a remote wallet (also called mobile wallet, digital wallet, cloud wallet or e-wallet) the parties and entities involved in the authorization and transaction process (like Remote mobile walletspayer and payee) are not physically close to each other. Hence the usage scenario is a remote authorization and transaction among the involved parties.

Remote mobile wallets are conceptually and historically closely linked to e-payments. They allow secure storage of payment data (“card-on-file”) and user identification information. A remote wallet is primarily used for payment transactions within e-commerce and m-commerce. It usually does not have a broad variety of services like a proximity wallet. It is rather more an aggregator to bundle various payment methods like credit cards, bank data for credit and direct debit transfers and so forth.

Usually, the sensitive data is stored remotely on cloud servers (thus the term cloud wallet). Furthermore, remote wallets can be connected with loyalty programs or further value-added services. Many remote wallets are also equipped with a central stored-value account (SVA) that allows users to make or receive payments using the enabled payment methods.

Many remote wallets are designed and used as a distinct payment method that can be embedded in merchant websites or apps. This means that the payment data details of the underlying payment method and sensitive customer information can be hidden from payees like retailers and financial intermediaries. The best-known example for such a remote wallet is PayPal.

Remote mobile wallets have been established in the e-commerce market for years and are becoming increasingly important in the field of mobile commerce. Remote wallet concepts have also been applied for mobile payment solutions that are decoupled from bank accounts. Often referred to as “mobile money,” such approaches have been successfully established in developing countries to provide financial services like cashless payments and cash deposits to the unbanked. M-Pesa by Safaricom is probably the most well-known example of that type of remote wallet.

Article Credits: Danny Fundinger Proximity and remote mobile wallets: What’s the difference?